Larger Expenses: SDIRAs normally have bigger administrative prices in comparison with other IRAs, as specific facets of the administrative procedure can not be automatic.

Assume your Pal could be starting up the next Facebook or Uber? By having an SDIRA, it is possible to invest in brings about that you suspect in; and probably enjoy higher returns.

No, You can not spend money on your individual company that has a self-directed IRA. The IRS prohibits any transactions in between your IRA along with your have company since you, since the proprietor, are thought of a disqualified person.

The tax pros are what make SDIRAs beautiful for many. An SDIRA can be both of those classic or Roth - the account sort you choose will rely mainly with your investment and tax strategy. Test using your monetary advisor or tax advisor should you’re Uncertain and that is very best for yourself.

Criminals often prey on SDIRA holders; encouraging them to open up accounts for the goal of earning fraudulent investments. They often fool investors by telling them that When the investment is approved by a self-directed IRA custodian, it should be legit, which isn’t real. Once again, Ensure that you do thorough homework on all investments you select.

Numerous buyers are shocked to find out that applying retirement money to speculate in alternative assets continues to be probable since 1974. On the other hand, most brokerage firms and banks target offering publicly traded securities, like stocks and bonds, as they deficiency the infrastructure and experience to deal with privately held assets, which include real estate or personal fairness.

Higher investment alternatives suggests you can diversify your portfolio beyond shares, bonds, and mutual funds and hedge your portfolio towards industry fluctuations and volatility.

Place simply just, should you’re hunting for a tax economical way to build a portfolio that’s much more tailor-made to the pursuits and know-how, an SDIRA could be the answer.

Opening an SDIRA can provide you with access to investments Usually unavailable via a financial institution or brokerage company. In this article’s how to start:

Have the freedom to take a position in almost any kind of asset with a chance profile that matches your investment method; together with assets which have the possible for a better fee of return.

An SDIRA custodian differs since they have the right staff members, skills, and ability to keep up custody in the alternative investments. The first step in opening a self-directed IRA is to locate a supplier that is certainly specialized in administering accounts for alternative investments.

Confined Liquidity: Lots of the alternative assets which can be held within an SDIRA, for instance real-estate, non-public equity, or precious metals, is probably not quickly liquidated. This can be a problem if you must access cash swiftly.

Housing is among the most popular alternatives between SDIRA holders. That’s because you'll be able to put money into any kind of real-estate that has a self-directed IRA.

Unlike shares and bonds, alternative assets are often more challenging to sell or can have demanding contracts and schedules.

Simplicity of use and Technological know-how: A consumer-welcoming platform with on line instruments to trace your investments, submit files, and handle your account is very important.

Generating essentially the most of tax-advantaged accounts allows you to hold more of the money you invest and receive. Depending on no matter whether you end up picking a standard self-directed IRA or even a self-directed Roth IRA, you may have the potential for tax-totally free or tax-deferred progress, furnished sure conditions are met.

Homework: It truly is termed "self-directed" for a cause. Using an SDIRA, you will be solely accountable for extensively exploring and vetting investments.

Of navigate here course, real estate property is among our consumers’ most favored investments, from time to time identified as a real estate property IRA. Purchasers have the option to invest in every thing from rental Qualities, commercial housing, undeveloped land, property finance loan notes plus much more.

Being an investor, on the other check my source hand, your options will not be limited to stocks and bonds if you decide on to self-immediate your retirement accounts. That’s why an SDIRA can change your portfolio.

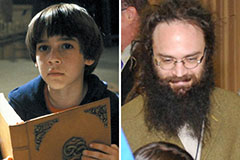

Barret Oliver Then & Now!

Barret Oliver Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now!